16th September 2010 - When is a school a business? …. Ask the VAT man!

- Last Updated: Thursday, 16 September 2010 14:22

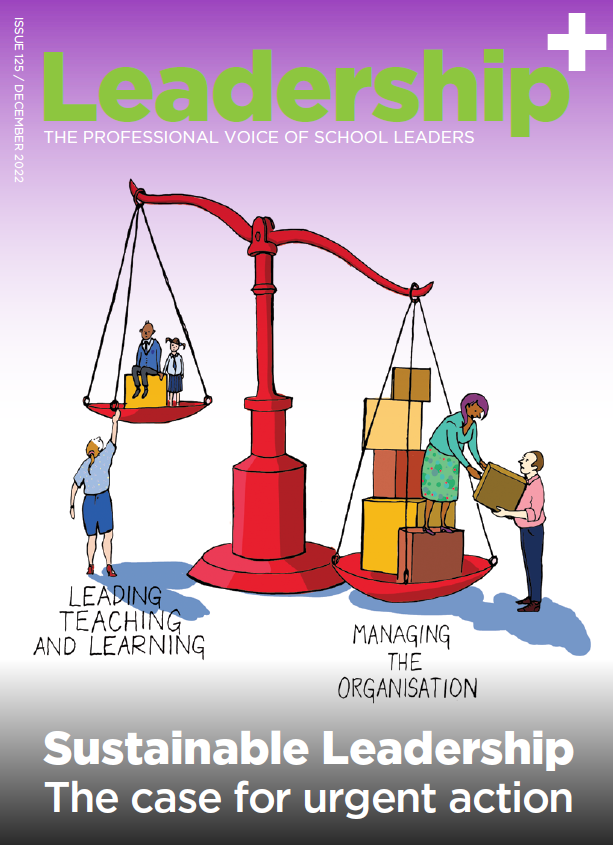

The Director of the Irish Primary Principals’ Network (IPPN), Seán Cottrell has asked the Chairman of the Revenue Commissioners to clarify ‘Why national schools are not entitled to claim VAT refunds like any other business, despite the fact that the Department of the Environment specifically categorises schools as businesses when imposing water charges?’

Mr. Cottrell has also called on the Commission for Taxation to ‘re-examine the whole area of schools and their tax anomalies, particularly in relation to VAT. The failure to exempt schools from VAT threatens to further undermine our education system with an increasing number of primary schools slipping further into debt’.

IPPN research findings highlight that the average 100-pupil school is operating at an annual deficit of €6,000. This shortfall has to be fund-raised by hard-pressed parents, as teachers fight an uphill battle to maintain Ireland’s position at the forefront of education globally’ said IPPN President, Pat Goff in his new school year message to 3,300 primary school Principals. ‘In these difficult times, many schools are struggling to meet the day-to-day costs of basics such as phone, insurance and energy bills. The government’s failure to grant schools the right to claim VAT refunds is discriminatory and places significant additional pressures on already hard-pressed families’ continued Mr. Goff.

'National schools are not-for-profit organisations with the sole purpose of delivering primary education, and should be eligible for charitable status and exempt from VAT’ said the IPPN President. ‘In Australia, schools can claim back VAT and even in an EU country such as Denmark, schools are exempt from VAT by virtue of their tax policy’ continued Mr. Goff.

ENDS